Costerfield Mine

The Costerfield operation is located in Victoria, Australia, within the Costerfield mining district, approximately 10 km northeast of the town of Heathcote, Victoria. Purchased in 2009, Mandalay Resources immediately restarted capital development and mining. By 2013, through extensive improvements and investments in mining and processing methods, the processing plant's capacity was expanded to approximately 13,000 tonnes per month from 5,000.

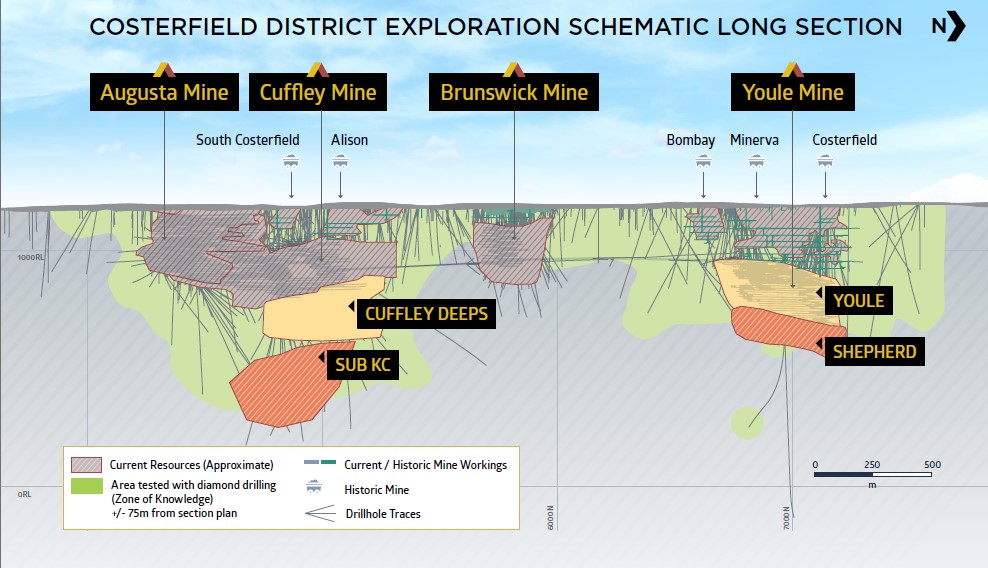

The Augusta mine has been operational since 2006 and was the sole ore source for the Brunswick processing plant until December 2013, when ore production started from the Cuffley deposit located approximately 500 m to the north of the Augusta mine workings. The Brunswick deposit is being mined in conjunction with the Youle deposit, which produced its first ore in August 2019. Currently, Youle and Shepherd are the main source of material for Costerfield.

The mining method employed is long-hole stoping with cemented rock fill. Ore is accessed by a primary spiral ramp. Level spacing is at 10 m centers and horizontal development is advanced in a minimum of 1.8 m wide drives in both directions of the deposit. Levels are then mined out on retreat with long hole stopes drilled to a minimum width of approximately 1.5 m. The stopes are subsequently backfilled with cemented rock fill to supply stability, reduce dilution, and allow for mining above and below developed levels.

Ore is trucked on the surface from the Augusta mine portal to the Brunswick processing plant, where it is stockpiled and blended into the processing circuit. Costerfield is currently planning a second mine portal at Brunswick. The circuit includes primary mobile crusher, primary and secondary ball mills, rougher, scavenger, cleaner flotation, gravity circuit, and filtering. Gravity gold concentrate is sold to a refinery in Melbourne, Victoria, and gold-antimony flotation concentrate is trucked to the port of Melbourne and shipped to a smelter in China.

Geology and Mineralization

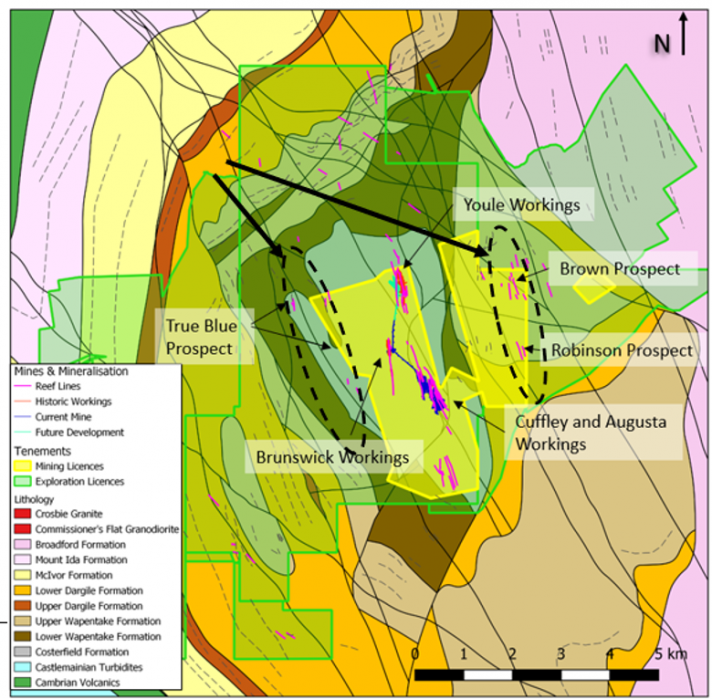

The Costerfield gold-antimony vein district, of which the Augusta Lodes are part, is located on the northern end of the Darraweit Guim Province. Stratigraphy in this area comprises a thick sequence of Lower Silurian to Lower Devonian shelf and flysch sedimentary rocks, dominated by turbiditic siltstone, with minor sandstone and argillite. These rocks form the Murrindindi Supergroup. At the base of the Supergroup is the Costerfield Formation, which is conformably overlain by the Wappentake (sandstone/siltstone) and Dargile (mudstone) Formations, the McIvor Sandstone and the Mount Ida Formation (sandstone/mudstone).

The north-trending Heathcote-Mt William fault system marks the western boundary of the Melbourne Trough in the Costerfield area.

The gold-antimony veins in the Costerfield district are hosted within the Silurian Costerfield Siltstone unit. Within the district, four north-northwest – trending zones of mineralization have been identified. They are, from the west:

- Antimony Creek Zone, approximately 6.5 km southwest of Costerfield, on the outer western flank of the Costerfield Dome;

- Western Zone, approximately 1.5 km west of Costerfield, on the western flank of the Costerfield Dome;

- Costerfield Zone, near the crest of the dome, centred on the Costerfield township and hosting the major producing mines and deposits; and

- Robinsons – Browns (R-B) Zone, 2 km east of Costerfield (see Figure below).

Exploration

The net decrease of 123,384 ounces of gold in Proven and Probable Mineral Reserves for end 2023, relative to end 2021, consists of the addition of 13,124 ounces of gold added by Mineral Resource conversion and addition of Mineral rResources to the Shepherd ore body and as well as a total of 110,259 ounces of gold depleted from the December 31, 2021 Mineral Reserves through mining production in 2022-2023 and through mining re-evaluation. The 8,970 tonnes of antimony net decrease in Proven and Probable Mineral Reserves consists of 793 tonnes of antimony added by Mineral Resources conversion and addition of Mineral Resources to Shepherd and 8,177 tonnes of antimony depleted from the 2023 Mineral Reserves through mining production in 2022-2023 and through mining re-evaluation.

Leading into 2024, Mandalay is continuing to focus centre its regional efforts on a number of prospective targets that present major growth opportunities at Costerfield. The expenditure for near mine exploration will remain constant around Shepherd but with additional focus now on the Cuffley Eextension programs as well as Brunswick Extension. In addition, Regionally, however, Mandalay has accelerated regional exploration with a major focus and 2024 centre of attention on the True Blue deposit ‘line’ with step-out drilling currently being undertaken over a prospective strike length of 1.5km.

Mineral Reserves and Resources

Costerfield Mineral Reserves 2024

| Tonnes (kt) | Au Grade (g/t) | Sb Grade (%) | Cont. Au (koz) | Cont. Sb (kt) | |

|---|---|---|---|---|---|

| Proven Underground | 307 | 11.4 | 2.1 | 113 | 6.5 |

| Proven Stockpile | 43 | 5.7 | 0.8 | 8 | 0.3 |

| Probable | 253 | 5.9 | 1.7 | 48 | 4.3 |

| Proven + Probable | 604 | 8.7 | 1.8 | 168 | 11.1 |

Costerfield Mineral Resources Inclusive of Mineral Reserves 2024

| Tonnes (kt) | Au Grade (g/t) | Sb Grade (%) | Cont. Au (koz) | Cont. Sb (kt) | |

|---|---|---|---|---|---|

| Measured Underground | 412 | 13.6 | 3.6 | 180 | 14.8 |

| Measured Stockpile | 43 | 5.7 | 0.8 | 8 | 0.3 |

| Indicated | 741 | 5.5 | 2.0 | 132 | 15.0 |

| Measured + Indicated | 1,197 | 8.3 | 2.5 | 320 | 30.2 |

| Inferred | 538 | 7.5 | 1.8 | 130 | 9.7 |

Technical Reports

Qualified Person

Chris Davis, Vice President of Operational Geology and Exploration at Mandalay Resources, is a Chartered Professional of the Australasian Institute of Mining and Metallurgy (MAusIMM CP(Geo)), and a Qualified Person as defined by NI 43-101. He has reviewed and approved the technical and scientific information provided in this release.

The Mineral Resource Estimate was independently reviewed and verified by Dr Andrew Fowler MAusIMM CP (Geo), a full-time employee of Mining Plus. He is a Qualified Person for the purposes of National Instrument 43-101. The Mineral Reserve estimate was independently verified by Aaron Spong MAusIMM CP (Min) who is a full-time employee of Mining Plus. He is a Qualified Person for the purposes of National Instrument 43-101.